Contents

Introduction

The buying and selling of oil, natural gas, refined products and other energy commodities has grown extremely complex. Energy trading firms now contend with real-time market volatility, geopolitical shifts, weather events, and an overwhelming amount of data.

To profit in today’s turbulent markets, traders require real-time visibility, predictive intelligence, and data-driven decision support. Unfortunately, many trading operations still rely on outdated tools and manual workflows.

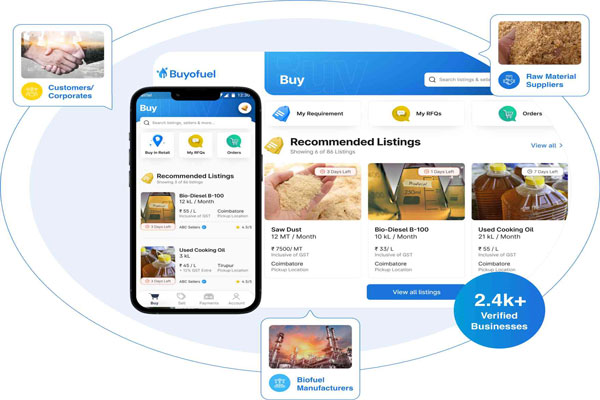

Buyofuel offers a solution with its AI-powered energy trading platform. Purpose-built for commodities markets, Buyofuel aggregates real-time data, generates actionable analytics, and provides customizable tools to enhance trading operations.

In this article, we explore how Buyofuel is leveraging big data, artificial intelligence, and design thinking to provide energy trading firms with optimized visibility, predictive insights, risk management, and operational efficiency.

By embracing Buyofuel’s innovative technology, traders can gain a distinct competitive advantage navigating the complexities of modern energy markets. Let’s examine the data-driven approach powering the future of energy trading.

Company Overview

Buyofuel was founded in 2018 by veterans of the finance and energy trading industry. The company is headquartered in New York.

Key facts:

- Founding team has 50+ years combined experience in commodities trading

- Raised $12 million in funding from leading fintech investors -Serves over 50 independent and integrated energy trading firms

- Platform handles over 1 billion data points daily

- Named a Top 25 Most Promising Energy Tech Company by Platts

Buyofuel’s founders sought to solve challenges they experienced first-hand in trading firms struggling to synthesize growing data complexity.

The company now employs over 60 data scientists, engineers, quant developers and energy experts to build and advance its AI-powered trading platform.

Platform Features

Buyofuel provides energy trading firms an integrated platform with the following core capabilities:

- Real-time data aggregation – Over 1,000 data feeds across markets, weather, logistics, geopolitics, ESG factors and more aggregated into a central interface.

- Predictive analytics – Proprietary AI algorithms generate actionable insights, price forecasting, market analytics, supply/demand modeling, and other predictive intelligence.

- Custom dashboards – Traders can build and customize visual dashboards for trading, risk management, logistics monitoring, yield optimization and other workflows.

- Mobile access – iOS and Android apps provide access to platform data, notifications and tools from anywhere.

- Alerting – Highly configurable alerts keep traders updated on price movements, breaking news, weather, ship schedules and other critical events.

- Team tools – Communication channels, task management, and document sharing foster collaboration across trading teams.

By centralizing data, generating predictive insights, and supporting customizable workflows, Buyofuel enhances visibility, productivity, risk management and decision making for energy trading operations.

Use Cases

Energy trading firms use Buyofuel’s platform for key functions including:

- Price forecasting – The AI algorithms provide accurate price predictions for crude oil, natural gas, refined products, coal and more. This informs trading strategy.

- Supply/demand modeling – Software models global supply and demand balances, inventories, logistics flows etc. to signal market direction.

- Risk management – Dashboards track real-time exposure across portfolios and geographies to optimize hedging and mitigation.

- Logistics optimization – Tools monitor vessel locations, weather, port operations to optimize cargo routes and chartering.

- Trading analytics – Traders get stats on technical indicators, volatility, spreads, momentum etc. to identify opportunities.

- Automated trading – Platform integrates with exchange APIs to enable automated algorithmic trading based on signals.

- Decision support – Insights, notifications and visualizations help traders execute quickly on market-moving events.

- Team collaboration – Integrated messaging and workflows improve coordination across front, middle, back office teams.

With its breadth of features, Buyofuel serves as a versatile hub powering key trading workflows, analysis, and real-time decision making.

Technology

Buyofuel leverages leading cloud, AI, and data technologies to power its energy trading platform:

- Cloud infrastructure – The platform is hosted on secure, scalable cloud infrastructure provided by AWS.

- Data integration – APIs, web scrapers, feeds and connectors ingest thousands of real-time data sources into the platform.

- Machine learning – Advanced ML algorithms generate predictive analytics, price forecasting, demand modeling and other intelligence.

- Mobile access – Native iOS and Android apps provide full platform access and notifications on mobile devices.

- Visualizations – The platform uses data visualization libraries like Plotly and Apache ECharts to render dashboards.

- Microservices – The platform comprises independently scalable microservices for data, ML models, dashboards etc.

- Kubernetes – This container orchestration enables easy deployment, scaling and management of microservices.

- Serverless computing – Cloud functions provide scalable computing for data processing workflows.

- Cloud data warehouse – Petabyte-scale cloud data lake for storing and analyzing vast quantities of historical data.

By leveraging leading enterprise technologies and cloud architecture, Buyofuel delivers a robust, scalable platform with advanced analytics tailored for energy trading.

Conclusion

Buyofuel stands at the forefront of leveraging big data, artificial intelligence, and design thinking to transform energy trading workflows.

The company’s platform aggregates real-time market data, generates predictive insights through machine learning, and enables customizable visualization dashboards. This empowers traders with enhanced visibility, risk management, decision automation, and predictive intelligence.

With an intuitive interface tuned to commodities trading and adoption by leading energy merchants, Buyofuel has validated its technology as a solution built by traders for traders.

As energy markets grow more volatile and complex, adopting data-driven platforms like Buyofuel will become key to realizing value, achieving efficiency, and strengthening competitiveness.

Buyofuel represents the data-first approach powering the next generation of energy trading. The company continues advancing its platform by exploiting new data sources, analytics techniques like deep learning, and delivery on mobile devices.

By embracing Buyofuel’s innovative energy trading platform, firms can transform workflows, unlock hidden insights, and maximize returns even as markets grow more turbulent.