Contents

Introduction

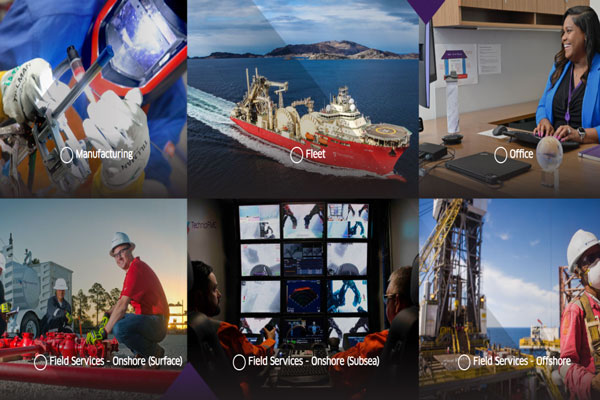

TechnipFMC is a leading global oil and gas services provider offering a wide range of project management, engineering, procurement and construction services. Formed in 2017 through the merger of Technip and FMC Technologies, the company has a diversified portfolio and proprietary technologies across subsea, onshore/offshore and surface projects. Headquartered in London, TechnipFMC has a global footprint with major operations in Europe, North and South America, Asia Pacific, Africa and the Middle East. This article provides an overview of TechnipFMC including its history, key business segments, technologies, financial performance and future outlook.

History

Technip was established in 1958 in France as a contracting company focused on onshore pipelines and facilities. Over the decades, it expanded into offshore oil and gas projects and downstream construction through major acquisitions globally.

FMC Technologies was formed in 2001 when FMC Corporation divested its machinery businesses and spun off its energy services unit as a separate public company. It quickly became a leader in subsea technologies for offshore energy markets.

In 2017, Technip and FMC Technologies merged to create TechnipFMC. This brought together upstream knowledge and subsea leadership to offer integrated solutions and improve project economics. The combined company employed around 37,000 people in 48 countries.

Key Business Segments

TechnipFMC operates through two main business segments:

- Subsea: Provides integrated design, engineering, manufacturing and installation services for subsea projects. Key offerings are subsea production systems, subsea trees, manifolds, controls, umbilicals and flowlines. The segment also supplies specialty hardware, equipment and robotic systems.

- Surface Technologies: Offers onshore facilities construction, process modules and liquid treatment systems. Services include conceptual design, engineering, modularization, site commissioning and maintenance.

The company is also involved in floating production units, loading systems and renewable energy projects. Its main clients are national and international oil companies as well as offshore contractors.

Technologies

TechnipFMC owns over 7,100 patents and has pioneered several breakthrough technologies used in the subsea oil and gas industry. Some key proprietary technologies include:

- Subsea 2.0 – Integrated production systems architecture to improve performance while lowering costs

- Agile – Subsea development approach using standardized designs and manufacturing

- Cybernetix – All-electric and digital controls technology for subsea equipment

- MagnastarTM – Pipe-in-pipe hybrid riser system for deepwater platforms

- Apollo – Subsea robotic drilling and intervention system

The company invests heavily in R&D, committing over $450 million annually towards new technologies and solutions development.

Financial Performance

For the year 2021, TechnipFMC reported revenues of $6.4 billion. While still below pre-pandemic levels, this marked a 22% increase over 2020 reflecting market recovery. Its net loss narrowed to $134 million from a $3.3 billion loss in 2020. Free cash flow was $373 million as working capital stabilized.

In the first half of 2022, TechnipFMC generated revenues of $3.2 billion, up 4% year-over-year. However, ongoing supply disruptions and cost inflation impacted margins. The company continues to focus on cash flow generation and debt reduction. It maintains a flexible capital structure, with a net cash position and no major debt maturities before 2025.

The separation of TechnipFMC’s engineering and construction segments in 2022 is also aimed at simplifying operations and driving greater value.

Future Outlook

Higher offshore activity and subsea tree awards underpin a positive long-term outlook for TechnipFMC. Global offshore project sanctions are forecast to rise over $100 billion annually through 2025. This will drive demand for the company’s integrated subsea solutions and technologies.

Geographic expansion in Asia Pacific, the Middle East and South America offers significant growth potential. The move towards all-electric and autonomous subsea systems also favors TechnipFMC given its industry-leading digital capabilities.

While macroeconomic headwinds persist, TechnipFMC’s early investment in LNG and transition to cleaner energy position it strongly. Its balanced portfolio across regions and diversified backlog provide resilience. Overall, TechnipFMC appears well placed to deliver growth and stakeholder value in the coming years.

Conclusion

As a global leader in subsea technologies with engineering expertise across the project lifecycle, TechnipFMC is at the forefront of offshore energy. Its pioneering solutions and execution track record make it a strategic partner for clients. While industry cycles and pricing pressures remain risks, TechnipFMC has transformed its capabilities and financial footing. With an improving outlook and focus on innovation, the company seems ready to harness new opportunities and drive performance.